As a departmental manager, one of your critical responsibilities is managing the budget. A well-managed

budget ensures the smooth functioning of the department, maximizes resources and fosters long-term

success. To help you navigate this crucial aspect of your role, we’ve compiled a list of best practices for

managing a departmental budget effectively. By implementing these strategies, you can ensure financial

stability and demonstrate your ability to make sound financial decisions.

Understand the Goals and Priorities:

Before diving into budget planning, it’s essential to align your department’s objectives with the

organization’s overall goals and priorities. Clearly understand what your department needs to achieve

and how it contributes to the success of the entire organization. This alignment will provide a solid

foundation for your budget decisions.

Analyze Historical Data:

Review past budget performance and expenditures to identify patterns and trends. Historical data will

give you insights into what worked well in the past and where there were inefficiencies. Use this

information to make informed decisions and create a realistic budget that reflects your department’s

needs.

Involve the Right People:

Collaboration is key when creating a budget. Involve key stakeholders, team leaders, and other relevant

personnel in the budget planning process. Their input and expertise will provide different perspectives,

leading to a more comprehensive and accurate budget.

Create a Detailed Budget Plan:

Develop a detailed budget plan that outlines all expected expenses and revenues. Be as thorough as

possible, accounting for regular operating costs, one-time expenses, salary and benefits, training and

development, equipment maintenance, and any other foreseeable expenses.

Account for Contingencies:

In the business world, unexpected events are inevitable. To avoid potential crises, set aside a portion of

your budget as a contingency fund. This reserve will act as a safety net during unforeseen circumstances,

helping your department weather challenges without disrupting core operations.

Monitor and Track Spending:

Once your budget is in place, it’s crucial to monitor and track spending regularly. Keep a close eye on

expenses to ensure they align with the budget plan. Implementing a robust tracking system allows you to

identify potential overspending or cost-saving opportunities early on.

Prioritize Value and Efficiency:

Make budget decisions based on the value and efficiency they bring to your department’s operations.

Look for ways to optimize spending without compromising the quality of work or employee satisfaction.

Emphasize investments that have a measurable impact on your department’s success.

Invest in Employee Development:

Consider investing in your team’s professional development. Well-trained employees can contribute

more effectively to the department’s success and reduce the need for external resources, ultimately

leading to cost savings in the long run.

Review and Adjust Regularly:

A departmental budget should never be static. Schedule regular budget reviews and be prepared to

make adjustments when necessary. Reevaluate your budget periodically, taking into account changes in

market conditions, organizational goals, or any other factors that may impact your department’s

finances.

Managing a departmental budget requires careful planning, collaboration, and ongoing monitoring. By

understanding your department’s objectives, analyzing historical data, involving key stakeholders, and

making strategic decisions, you can effectively manage your budget while achieving your goals.

Remember to prioritize value, invest in employee development, and stay adaptable by regularly

reviewing and adjusting your budget as needed. With these best practices in place, you can foster

financial stability and lead your department to long-term success.

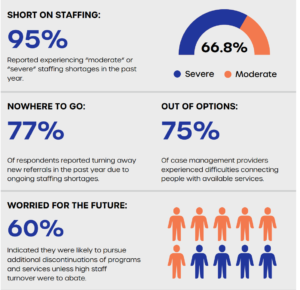

BloomTrak 2024: Navigating the New Norm in Senior Living Staffing and Financial Efficiency

In the wake of staffing shortages and financial constraints, senior living communities are increasingly turning